The Ultimate Guide To Accountants

Wiki Article

What Does Fresno Cpa Mean?

Table of ContentsExamine This Report on AccountantsThe smart Trick of Accountants That Nobody is DiscussingThings about Fresno CpaGetting The Certified Accountant To Work

Getty Images/ sturti Contracting out accountancy services can maximize your time, prevent mistakes and also reduce your tax costs (accounting fresno). The dizzying variety of options might leave you baffled. Do you require an accountant or a cpa (CPA)? Or, perhaps you intend to handle your general bookkeeping tasks, like accounts receivables, but work with an expert for capital projecting.

Tiny company proprietors likewise analyze their tax burden and also stay abreast of upcoming changes to stay clear of paying more than needed. Generate financial statements, consisting of the balance sheet, revenue as well as loss (P&L), cash money circulation, and income statements.

, offer financial planning guidance and also discuss monetary statements. You can outsource chief economic policeman (CFO) services, such as succession preparation and also oversight of mergers and acquisitions.

The smart Trick of Certified Cpa That Nobody is Discussing

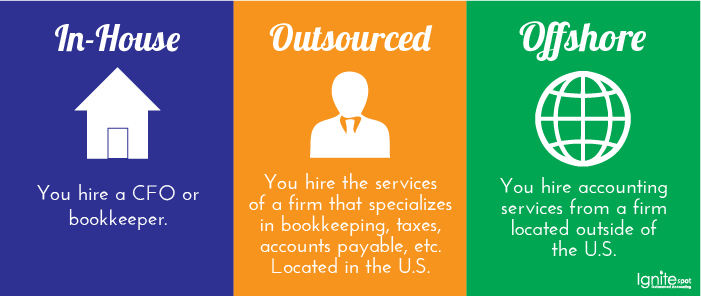

Usually, small company proprietors contract out tax solutions first as well as add payroll aid as their company grows. According to the National Small Organization Organization (NSBA) Small Company Taxation Study, 68% of respondents utilize an exterior tax obligation specialist or accounting professional to prepare their firm's taxes. In comparison, the NSBA's Modern technology as well as Business Study located that 55% of small company owners take care of pay-roll online, and 88% manage financial accounts electronically.Create a listing of processes as well as responsibilities, as well as highlight those that you agree to outsource. Next, it's time to discover the best accounting service company. Since you have a suggestion of what sort of bookkeeping solutions you need, the question is, that should you work with to provide them? For instance, while an accountant manages information access, a CPA can talk on your part to the internal revenue service and offer financial suggestions.

Before determining, think about these concerns: Do you want a neighborhood accounting specialist, or are you comfy functioning essentially? Does your service need market understanding to execute accountancy tasks? Are you looking for year-round aid or end-of-year tax obligation management solutions?

What Does Fresno Cpa Do?

Expert business advice, news, and patterns, provided once a week By joining you accept the carbon monoxide Privacy Plan. You can opt out anytime. Published November 30, 2021.:max_bytes(150000):strip_icc()/Accounting-FINAL-e01e0f2d93264a989c19357a99d7bffd.jpg)

In the United States, the certified public accountant designation is managed by individual state boards of accountancy. To come to be a CERTIFIED PUBLIC ACCOUNTANT, a private normally requires to finish a certain variety of university program credit scores in accounting as well as business-related topics, acquire a particular quantity of sensible experience in the field, and also pass the Uniform State-licensed accountant Assessment (Certified Public Accountant Examination).

Management or supervisory accounting professionals make use of economic details to assist organizations make informed business decisions. They are accountable for supplying monetary data as well as analysis to managers and also creating and carrying out monetary systems as well as controls.

The Best Guide To Certified Cpa

They may be associated with activities such as preparing economic records, establishing budget plans, assessing economic information, and developing financial models to help supervisors make educated choices regarding the company's procedures as well as future direction. In comparison to public accounting professionals, who normally deal with a variety of customers as well as concentrate on outside monetary coverage, administration accountants function mainly with the financial details of a single organization.

A Chartered Accounting Professional (CA) is a specialist accounting professional who has actually met certain education and learning as well as experience demands and also has been given a professional accreditation by an identified accountancy body. Chartered Accountants are typically thought about amongst the highest degree of professional accountants, as well as the CA designation is recognized and valued worldwide. To become a Chartered Accounting professional, a private normally needs to finish a certain degree of education in accounting and associated topics, acquire a certain quantity of functional experience in the area, and pass a professional accreditation exam.

Numerous various expert bookkeeping bodies approve the CA classification, consisting of the Institute of Chartered Accountants in England and also Wales (ICAEW), the Institute of Chartered Accountants of Scotland (ICAS), and also the Institute of Chartered Accountants in Ireland (ICAI). The needs and also treatments for becoming a Chartered Accounting professional vary depending upon the details expert body (accounting fresno).

Report this wiki page